As the year winds down, it’s an ideal time to pause, review your finances, and identify any strategies that could help lower your upcoming tax bill. The recently enacted One Big Beautiful Bill Act (OBBBA) made a few adjustments to the Federal tax code, but for most taxpayers, the familiar rules from recent years still apply. The steps you take (or miss) before year-end can often make big differences come tax time.

Here are some important items for taxpayers to keep in mind for a tax-efficient close to the year.

Standard vs. Itemized Deductions

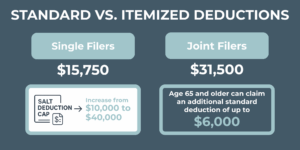

In 2025, the standard deduction is $15,750 for single filers and $31,500 for married couples filing jointly. Taxpayers age 65 and older can claim an additional standard deduction of up to $6,000 (subject to adjusted gross income limits and filing status), available through 2028.

Under the OBBBA, many of the itemized deduction benefits that were once more generous remain limited, while the standard deduction remains relatively high. However, a notable change was made to the state and local tax (SALT) deduction cap, which increased from $10,000 to a maximum of $40,000 (subject to adjusted gross income limits) beginning in 2025.

It’s important to know whether you expect to take the standard deduction before making decisions on year-end spending items that generate itemized deductions, such as charitable gifts, state tax payments, or elective medical expenses. If you take the standard deduction, these expenses won’t provide an additional federal tax benefit.

Does it make sense to “bunch” deductions?

If you don’t have enough deductible expenses to itemize every year, a strategy known as “bunching” can be useful. For example, if you typically give $20,000 to charity each year but don’t exceed the standard deduction, you could consider:

- Combining two years’ worth of donations (for example, making both your 2025 and 2026 charitable contributions by gifting $40,000 this year).

- Itemizing deductions in 2025 to take advantage of the larger tax benefit.

- Taking the standard deduction in 2026 when you forgo additional charitable giving.

The same concept can also apply to medical expenses, which are only deductible to the extent they exceed 7.5% of your adjusted gross income (AGI). In some instances, concentrating elective medical or dental procedures in a single year may help you reach that threshold and increase your deduction.

“Bunching” deductions can be especially useful if your income is higher this year than it’s projected to be in future years. With higher standard deductions, bunching is one of the few ways to maximize itemized deductions in alternate years, especially while current rules remain in effect through 2025.

Charitable Contributions: Gifting Cash vs. Appreciated Securities

When making charitable gifts, donating long-term appreciated securities instead of cash can often provide greater tax efficiency. This approach offers two potential benefits:

- You get a charitable deduction equal to the fair market value of the securities on the donation date (rather than your original cost basis).

- You avoid paying capital gains tax on the appreciated amount, which you otherwise would incur if you sold the securities first and then donated cash.

Additionally, if you want to take advantage of a charitable deduction but don’t know which specific charities you want to donate to, you can fund a donor-advised fund (DAF) with appreciated securities. Doing so allows you to make the contribution and claim the deduction in 2025, while retaining the flexibility to decide later how to direct grants to specific charitable organizations. This can be particularly useful in a year when income is higher or when you are implementing a “bunching” strategy.

Beginning in 2026, new rules under the OBBBA will change how charitable deductions work. Only contributions exceeding 0.5% of AGI will qualify as itemized deductions. As a result, some taxpayers may find it worthwhile to review potential charitable giving plans in 2025 while current rules are in effect.

Also starting in 2026, taxpayers who take the standard deduction will be eligible for a small above-the-line charitable deduction. Qualifying cash contributions can be deductible up to $1,000 for single filers and $2,000 for married couples filing jointly.

Qualified Charitable Distributions (QCDs)

Normally, taxpayers are required to make required minimum distributions (RMDs) out of their IRAs and other retirement plans upon reaching age 73. These distributions are taxed as ordinary income. However, those who are charitably inclined may be able to use a Qualified Charitable Distribution (QCD) to satisfy some or all of their RMD while reducing taxable income.

Key rules and limits for 2025:

- Available to IRA owners age 70½ or older

- The distribution must go directly from an IRA to a qualified public charity (donor-advised funds do not qualify).

- For 2025, up to $108,000 may be distributed via QCDs.

- Since the amount distributed through a QCD is excluded from taxable income, you cannot also claim a separate charitable deduction for it.

QCDs can be an effective strategy for taxpayers who were already planning to make charitable gifts and do not need their full RMD for living expenses. For some taxpayers, however, donating appreciated securities may offer greater tax advantages depending on the situation, so it’s worth evaluating both options carefully.

Utilizing IRA Tax Withholding

The IRS treats tax withholding from IRA distributions differently from estimated tax payments. When tax is withheld from a required minimum distribution (RMD), it is considered as having been paid evenly throughout the year, not just at the time of the distribution.

This treatment can help taxpayers avoid potential underpayment penalties, especially if quarterly estimated payments were uneven.

If a taxpayer’s expected RMD amount is sufficient to cover total tax withholding for the year, it may be worth considering taking the RMD later in the year and withholding taxes at that time. This allows IRA assets to remain invested longer, though the timing must still comply with IRS RMD requirements and take into account cash flow needs.

Harvesting gains or losses in your portfolio

Harvesting capital gains or losses is one strategy that can help manage taxable income, take advantage of favorable tax brackets, and set up the portfolio for future flexibility.

Tax-Loss Harvesting

- If a security has declined in value, selling it at a loss can offset realized capital gains and up to $3,000 of ordinary income.

- The proceeds can be reinvested in a similar, but not “substantially identical” asset, which maintains market exposure.

- Unused realized losses become a tax asset that can be carried forward into future years to offset gains or income.

Tax-Gain Harvesting (in low-income years)

- Taxpayers in a 0% long-term Federal capital gains bracket may sell appreciated securities to lock in gains taxed at 0%, then immediately repurchase to reset cost basis.

- Immediately repurchasing the same position after selling it for a gain resets the cost basis and maintains market exposure.

Harvesting gains or losses can help taxpayers strategically manage taxable income and preserve flexibility in investment portfolios. Whether using losses to offset gains or gains to reset basis, these strategies should be evaluated in the context of overall portfolio goals and future income expectations.

Utilizing State Tax Credits

While federal tax planning often takes center stage, state tax benefits can also provide meaningful savings. To promote social welfare, many states offer tax benefits for contributions to specific areas. A few key points related to Arizona’s charitable tax credits:

- Donations can be made through April 15, 2026 and still qualify as 2025 state tax credits.

- Qualifying charities include organizations that support:

- Low-income residents

- Disabled or chronically ill individuals

- Foster children

- Private school tuition organizations

- Public schools

- Military programs

- Contributions may provide a dollar-for-dollar reduction of Arizona state tax liability.

- Visit AZ Department of Revenue’s website for a full list of eligible organizations.

State tax credits can complement federal planning and help taxpayers direct resources toward causes they value, while potentially reducing overall tax liability.

Retirement Plan and HSA Contributions

Most taxpayers have the opportunity to make contributions to retirement and health savings accounts before the end of 2025 and into the filing season:

Retirement Plan Contribution Deadlines:

- Traditional and Roth IRAs: Contributions for 2025 can generally be made up to the April 15, 2026 tax filing deadline.

- Employer-sponsored retirement plans (i.e., 401(k), 403(b)): Employee salary deferrals for 2025 generally must be made by December 31, 2025.

- SEP-IRAs and individual 401(k)s (for self-employed individuals or small business owners): Contributions can typically be made up to the tax filing deadline, including any extensions.

Health Savings Accounts (HSA) Contributions:

- Taxpayers enrolled in a qualified high-deductible health plan (HDHP) may contribute to an HSA.

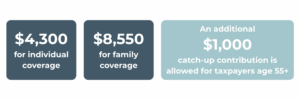

- Contribution limits for 2025:

- $4,300 for individual coverage

- $8,550 for family coverage

- An additional $1,000 catch-up contribution is allowed for taxpayers age 55 and older

- Contributions grow tax-deferred, and distributions used for qualified medical expenses are tax-free.

- Contributions for 2025 can generally be made up to April 15, 2026, if the taxpayer is eligible.

Retirement and HSA contributions provide both long-term savings opportunities and potential tax benefits. Planning contribution timing before the end of the year or the filing deadline can help take advantage of these benefits while aligning with other cash flow and financial goals.

Distributing Income from Trust and Estate Accounts

Irrevocable trusts and estates reach the highest income tax brackets very quickly, so distributing income to beneficiaries in lower tax brackets can often reduce the overall tax burden. This strategy allows the income to be taxed at the beneficiaries’ rates rather than the higher trust or estate rates.

For all applicable accounts, we review income distributions annually. We evaluate distributions in light of family dynamics, asset preservation, and long-term estate planning goals, not just tax minimization.

Many trusts also allow a 65-day window after year-end to elect to treat distributions as having been made in the prior year. This can provide additional flexibility in managing taxable income and coordinating distributions with beneficiaries’ tax situations.

Thoughtful planning around trust and estate distributions can help manage taxes while supporting broader family and legacy objectives. Decisions are generally best coordinated with a team of financial, legal, and tax advisors to balance tax considerations with long-term goals.

Annual and Lifetime Gifting

For taxpayers with wealth-transfer goals, year-end can be an important time to review potential gifts to children, grandchildren, or other beneficiaries.

Annual Gift Tax Exclusion (2025):

- Up to $19,000 per recipient can be gifted without triggering Federal gift tax reporting.

- Gifts may take several forms, including:

- Cash

- Securities

- Contributions to custodial, education, or retirement accounts

- Direct payments made directly to educational or medical institutions are unlimited and do not count against the $19,000 limit.

Lifetime Gift and Estate Tax Exclusion:

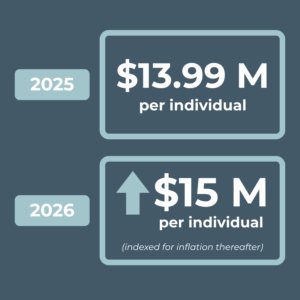

- For 2025, the Federal lifetime estate and gift tax exclusion is $13.99 million per individual.

- Beginning in 2026, under the OBBBA, the exclusion increases to $15 million per individual, indexed for inflation thereafter.

Making gifts before year-end can be a strategic part of overall tax and estate planning. Taxpayers with substantial estates may benefit from taking action while current rules are in effect, but any decisions should be evaluated in the context of long-term financial and legacy goals.

Deliberate year-end planning can make a meaningful difference in managing taxes, supporting family and charitable goals, and positioning portfolios for the year ahead. From charitable giving to trust distributions, strategic planning can help take advantage of opportunities. Coordination with a trusted team of financial, tax, and legal advisors can help align strategies with long-term objectives and support confident implementation.

We encourage clients to contact their Luminescent team to review options, evaluate potential impacts, and discuss strategies that may align with their broader financial goals.

Disclosure:

This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third-party sources and is believed to be reliable; however, its accuracy is not guaranteed and should not be relied upon in any way whatsoever. This presentation may not be construed as investment, tax or legal advice and does not give investment recommendations. Any opinion included in this report constitutes our judgment as of the date of this report and is subject to change without notice.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2, available upon request or at the SEC’s Investment Adviser Public Disclosure website,www.adviserinfo.sec.gov. Past performance is not a guarantee of future results.